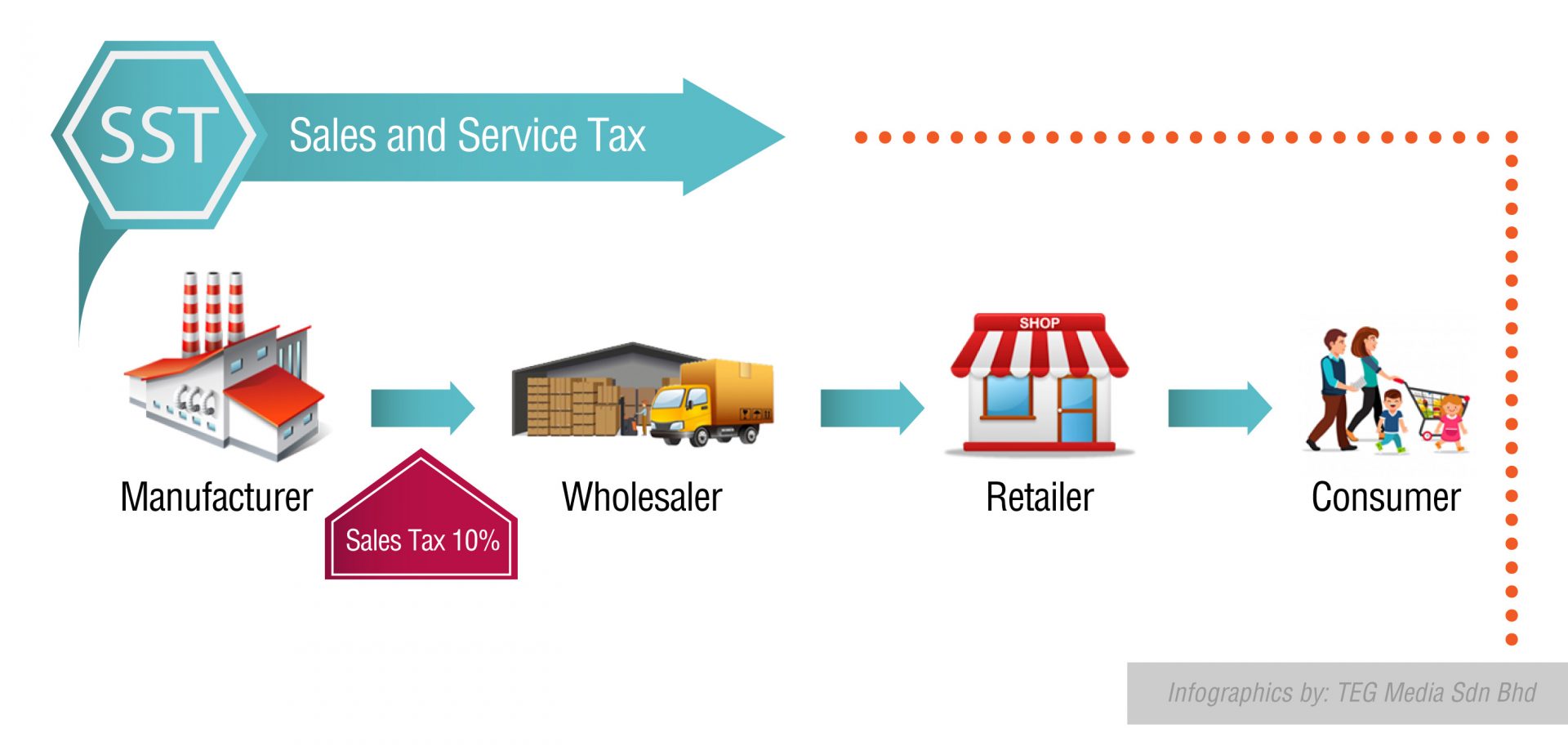

Wholesalers and retailers will not be required to pay the 10 tax which means they will not be required to prepare tax. It offers smaller companies the ability to file their tax returns through an.

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

As a conclusion GST will enable the public to strengthen Malaysias economy and improve the quality of life.

. Goods and Services Tax and it is a consumption tax based on the value added concept. GST registration has been made online which makes it simpler for people who are doing company registration in Malaysia for the very first. I have figured out 18 advantages of GST over normal tax system lets discuss them first.

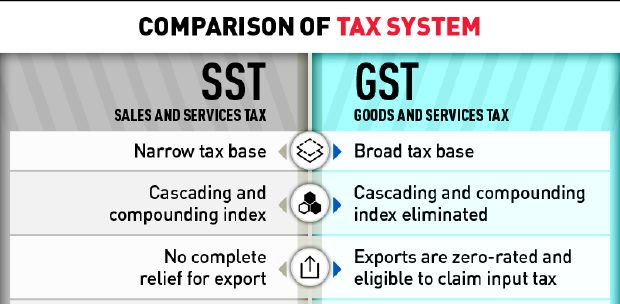

Let us see what benefits and drawbacks GST brought to the economy. Before the GST implementation no set off against output VAT was provided on the service tax paid on input services. Eliminated the cascading effect of taxes on the economy.

It is a unified destination based indirect tax that subsumes a host of taxes and reduces the tax compliance. Advantages and Disadvantages of SST Malaysia 2019. Furthermore as GST has a self-policing mechanism it helps the business to improve compliance.

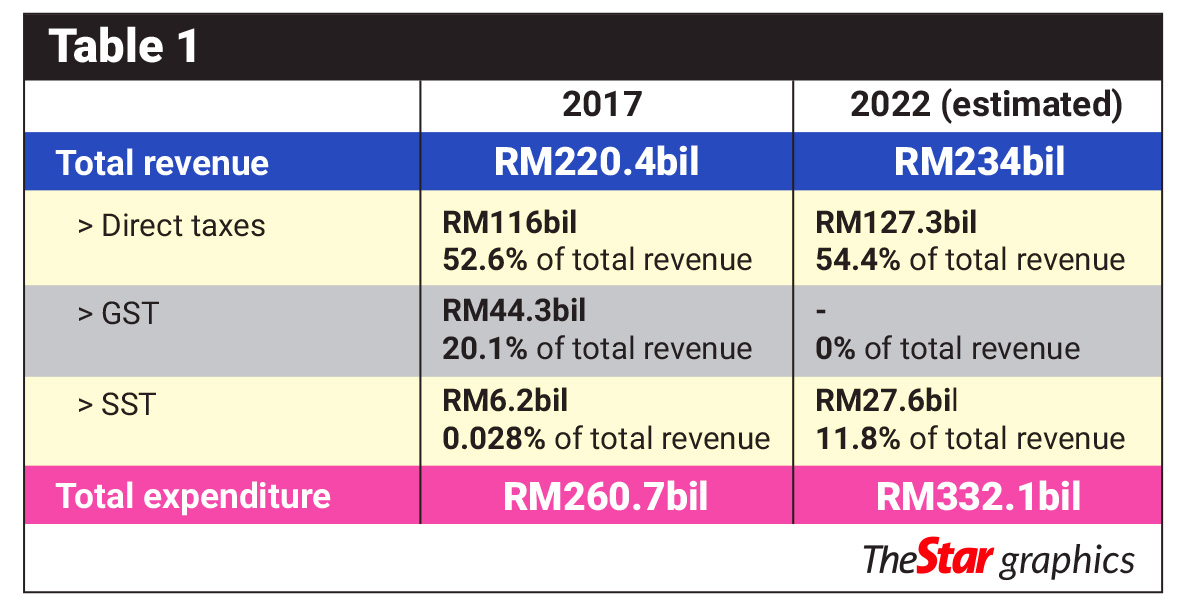

Under the new Sales and Services tax sales tax is levied on specifically identified classes of. The basic fundamental of GST Malaysia is its self-policing features which allow the businesses to claim their Input tax credit by way of automatic deduction in their accounting system. Last year on the 1 st of September Malaysia replaced its Goods and Services Tax GST with Sales and Services Tax SST.

The implementation of GST will not be a burden for citizens. GST ADVANTAGES CONTD 37 BENEFITS OF GST CONTD Transfer pricing Manufacturing goods Under declaring 1 Eliminating hidden Imported goods activity 2 Greater Transparency GST will be shown on the invoice Consumers will know exactly whether the goods they consume are subject to tax and the amount they pay for. Stage in the supply chain including importation of goods and services.

Removal of tax on tax. Advantages of GST implementation in Malaysia In Malaysia GST is imposed on goods and services at every production and distribution. GST is also one of the overall tax reform parts at where it make the taxation system to be more effective efficient transparent business friendly and it will also be capable in generating more stable source of revenue to the country.

GST has lowered taxes on some goods by 2 percent and others by 75 percent for example on smartphones and cars. GST is introduced in Malaysia to replace the current consumption tax which is the Sales Tax and Service Tax because it has many weaknesses. Discuss the advantages and disadvantages of this policy towards Malaysian consumers.

Other than that it helps to lower down the level of bureaucracy as no approval is required for exemption on raw materials which will speed up the process and increase efficiency. GST has advantages to certain degree because the revenue increased is not just from local people but from the foreigners too. Easy and simple method of registration.

GST provides fiscal uniformity and allows for unified registration. If you are looking for what are the advantages of GST lesser and easier compliance is one of the most important ones. There are no hidden taxes.

The enforcement of the GST Act has made tax administration transparent and corruption-free. 1 The most important benefit is the removal of cascading effect ie. GST in Malaysia is proposed to replace the current consumption tax.

In addition retail prices will come down as GST enclosed indirect taxes and cuts out the cascade of multiple taxes that products. Under the new tax regime there is only a single unified GST return to be filed. Both of these are indirect tax regimes charged on certain taxable goods and services.

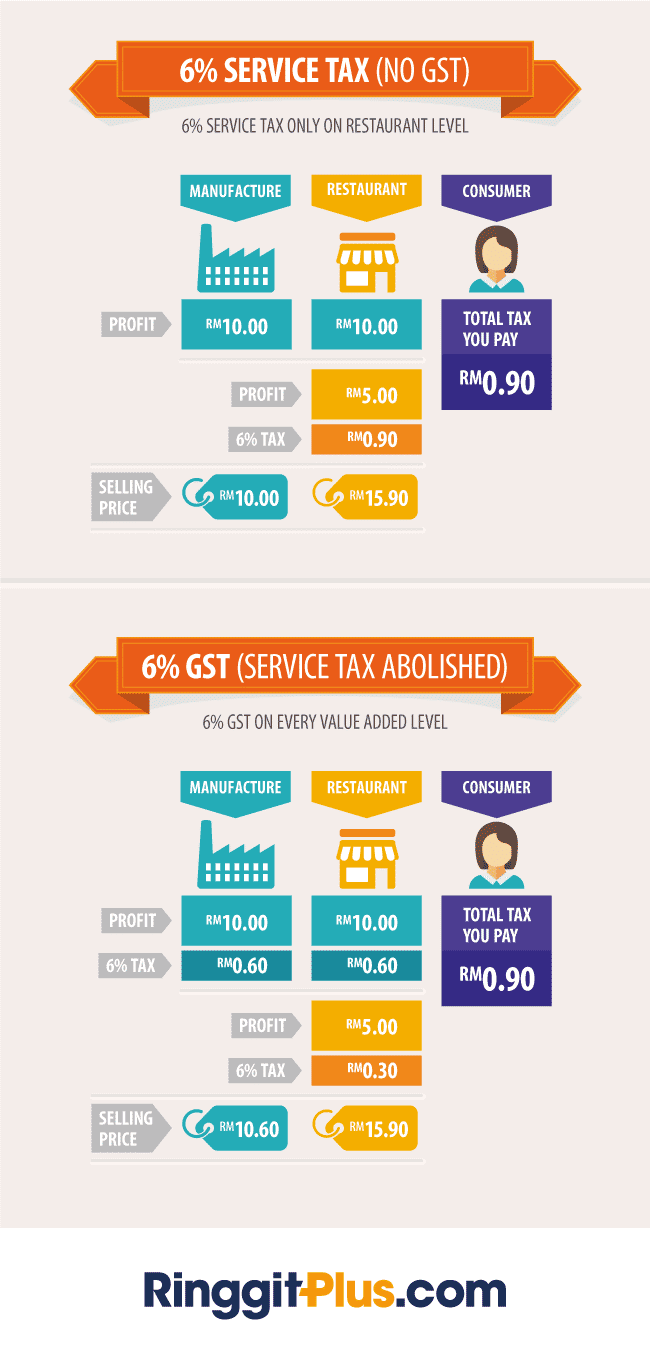

First and foremost the advance of GST on consumer compare with sales tax is Fair Pricing to Consumers. The most important is that the consumption tax in the early course of the implementation of any weak link should be improved and re designed to create a win-win situation involved in all the parties. This is because GST eliminates double taxation under SST.

Compared to any other tax registration process GST registration in Malaysia can be done with ease. Moreover the entire process of registering for GST and filing returns can be easily completed online. Consumers will pay fairer prices for most goods and services compared to SST.

GST will eliminate the double taxation under SST. These are as follows. Easy and Simple Registration Process.

Advantages Fairer pricing Under GST the consumers will pay the same amount of tax which is 6 to certain particular goods and services. This means consumer will payshow more content DrPaulMJohnson. Consumers only pay a 10 factory price unlike the GST multi-stage tax.

The collection of the GST can increase the revenue from the tourism industry as some revenue is extracting directly from tourists where the tourists spend on goods and services that made in Malaysia and overall government revenue will be increased. Advantages It is a 10 single tax that is imposed on importers or factories. Advantages of GST.

Therefore the end consumer. GST has advantages to certain degree because the revenue increased is not just from local people but from the foreigners too. The advantages of GST are many.

The GST also allows the government to reduce the corporate and income taxes.

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

We Pit A 5 Year Old Myvi Mercedes Benz C Class Honda Civic Toyota Vios And Mini Cooper Against Each Other The Winner Honda Civic Toyota Vios Toyota Innova

Sst Vs Gst How Do They Work Expatgo

Gst Better Than Sst Say Experts

Malaysia Gst Baby Milk Baby Mittens Baby Formula

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sst Vs Gst How Do They Work Expatgo

Point Of Sales System Malaysia Online Pos Software Cashier Machine Restaurant Pos Pos Terminal Cash Register Sql Accounting Sst Tax Invoice Simple Pos

Gst Vs Sst In Malaysia Mypf My

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Insight More Prosperous With Prosperity Tax The Star

Gst Better Than Sst Say Experts

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated